Let your money work for you

under the Spanish sun

With an average value increase of 9.41% per year, investing in Spanish residential real estate is a smart choice.

Costa Blanca, Costa del Sol, and the emerging Costa Cálida offer strong rental opportunities and personal use. With financing, you increase your return through leverage — making the most of both your investment and holidays.

-

€ 1864 - € 5092

Average property prices (per m²)

-

From €219,000

Starting amount for a solid investment

-

7,93 - 15%

Average annual price increase (2015–2025)

-

4 - 8%

Average rental yield (holiday rentals)

Why choose to invest

in Spanish real estate?

-

Attractive entry prices

Compared to other European countries, Spain still offers appealing purchase prices, especially in up-and-coming regions like Costa Cálida. This makes the threshold low and the return attractive.

-

High tourist demand

Spain is one of the most popular holiday destinations worldwide. This makes it ideal for renting to holidaymakers with excellent occupancy rates in both summer and winter.

-

Strong capital growth

Spain has seen a steady rise in property prices for years, especially in sought-after areas like Costa Blanca and Costa del Sol. Investing means benefiting from long-term value appreciation.

-

Financing available for non-residents

Even as a non-resident, you can finance up to 70% of your investment through a Spanish bank, maximizing leverage.

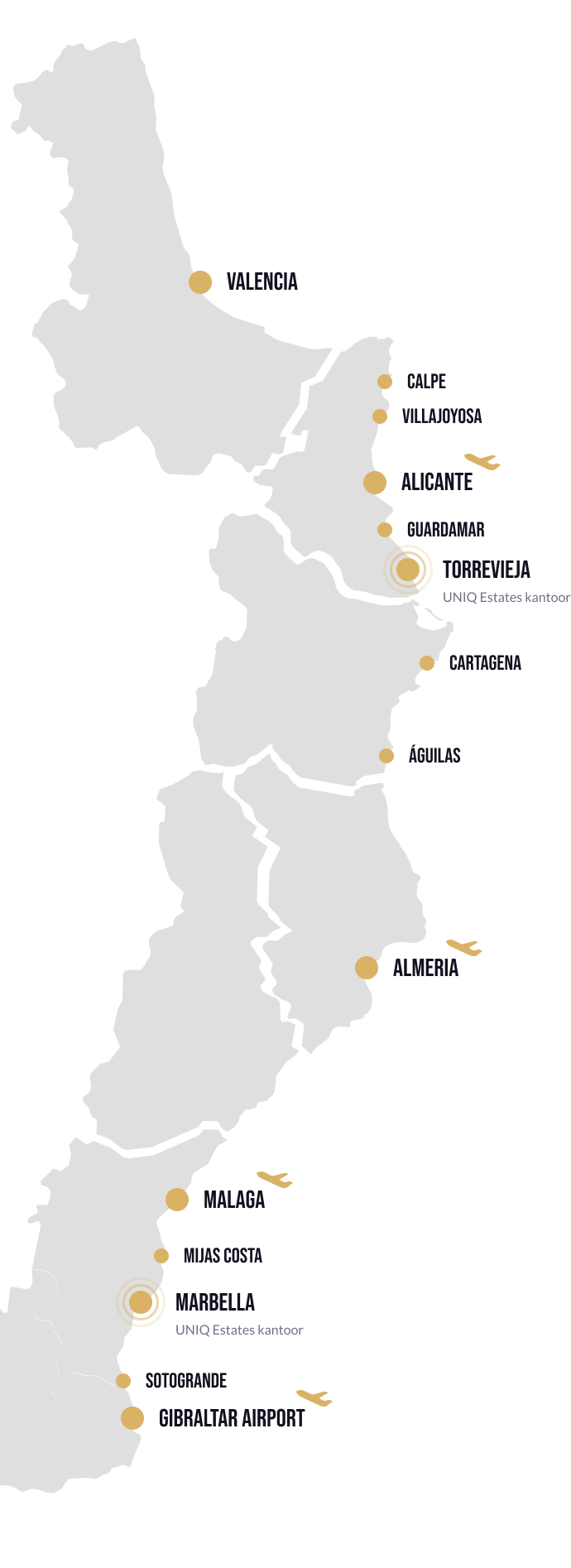

Regions where our clients have invested

Price evolution over the past 10 years

Click a location to discover the price trends

- Torrevieja

- Orihuela Costa

- San Pedro Del Pinetar

- Finestrat

- Estepona

- Marbella

Based on current data from an Idealista study

Safe and secure investing with UNIQ Estates

Full guidance from A to Z

-

Complete guidance from A to Z

UNIQ Estates works with reliable partners and handles the full rental process and follow-up for the client, allowing full focus on investment returns.

-

Thorough market knowledge and analysis

With in-depth knowledge of local markets, UNIQ Estates presents the best investment opportunities based on current trends and pricing.

-

Selection from 500+ new build projects

From over 500 new developments in Spain’s most popular regions (Costa Blanca, Costa Cálida, and Costa del Sol), UNIQ Estates filters the most suitable options tailored to each investor’s goals.

Still not convinced?

5 reasons to go for it!

-

Affordable luxury

Modern apartments and villas at attractive prices.

-

Strong rental market

High demand for holiday and long-term rentals = stable returns.

-

Growth potential and security

A stable market with increasing value and ongoing international interest.

-

Enjoy and invest at the same time

Rent for stable income, and use it yourself when it's available.

-

Better than in Belgium or the Netherlands

Lower purchase prices for new builds result in higher returns and better opportunities than back home.

-

Smart investing in Spain?

Start now!

Schedule an appointment

Take the first step toward your next investment

During a one-on-one appointment at our office in Schoten or Eindhoven, you’ll receive personal advice on investing in Spanish real estate.

We’ll discuss the most interesting regions, current investment projects, and expected returns. You’ll also get insights into the buying process, tax considerations, and financing options. UNIQ Estates will guide you through every step of your investment in Spain.

Become one of our

Happy and successful clients

-

Anthony G.

For the second time in a row, our real estate investment company has bought a property through Serge.

We chose UNIQ Estates with our company because Serge and Stijn connected us closely with all the necessary parties involved in purchasing real estate in Spain. Very satisfied with the professional approach and after-service! -

Toon E.

Excellent support from start to even after completion. Highly recommended. Erna did a fantastic job with her follow-up and advice.

If we had to start again tomorrow, we wouldn’t hesitate — we’d partner again with UNIQ Estates. A solid 5 stars from us! -

Bart W.

Excellent guidance in the search for Spanish real estate. Full support with all details discussed beforehand in Belgium, including tax matters, regulations, hidden costs, etc. We never felt pressured to buy.

For anyone considering investing under the Spanish sun, we highly recommend UNIQ Estates!

Questions about investing in Spain?

Find answers to all your questions here!

-

What’s the minimum investment for property in Spain?

-

Is it better to invest with or without financing?

-

Is tourist rental of your Spanish home allowed?

-

How much tax do I pay on rental income in Spain?

-

How much capital gains tax will I pay when selling my Spanish property?

-

Do I need to manage bookings and cleaning myself?

-

Can I invest in Spain through my Belgian or Dutch company?

-

How does UNIQ Estates select good investment projects?